Browse the Globe of Car Financing Providers With Self-confidence: Important Tips and Insights

With numerous funding choices, lease arrangements, and rate of interest rates to think about, the procedure can rapidly become frustrating. Chevy service center. By unwinding the complexities of financing choices and furnishing on your own with important tips, you can with confidence browse the realm of auto financing solutions to safeguard an offer that works finest for you.

Understanding Automobile Funding Essentials

When delving right into the world of car financing, realizing the fundamental principles of auto loan is crucial for making informed decisions. Recognizing automobile finance fundamentals is vital for individuals aiming to buy a vehicle through funding. A cars and truck financing is a kind of financial item that enables people to borrow a details quantity of money from a lending institution to buy an automobile. The borrower then pays back the funding quantity, plus any kind of passion, over an agreed-upon duration.

Rate of interest prices play a considerable function in vehicle loan, as they figure out the cost of obtaining cash. A greater rate of interest implies greater overall costs for the consumer. Financing terms, including the length of the loan and monthly payments, likewise impact the total quantity paid off.

Decoding Lease Contract Terms

This consists of the negotiated rate of the cars and truck along with any kind of added costs. Another vital term is "residual worth," which symbolizes the approximated worth of the automobile at the end of the lease term. "Money aspect" is an additional term to pay focus to, as it represents the interest price made use of in determining the lease settlement.

Comparing Funding Alternatives Sensibly

Reduced interest prices can considerably reduce the overall expense of the financing. A longer funding term might result in reduced regular monthly settlements but could finish up setting you back a lot more due to accruing rate of interest over a much more extensive duration. On the various other hand, a much shorter finance term may have higher month-to-month settlements yet might conserve you cash in passion in the long run.

In addition, take note of any extra costs or costs connected with the financing alternatives. Some lenders may have origination costs, prepayment charges, or other hidden expenses that can affect the click here to read cost of the lending. It's crucial to factor in all these aspects when contrasting funding alternatives to select one of the most cost-effective and ideal alternative for your monetary circumstance. By very carefully examining rates of interest, loan terms, regular monthly payments, and any type of added costs, you can make a well-informed choice that straightens with your budget and economic objectives.

Tips for Discussing Rate Of Interest Prices

An additional pointer for bargaining rates of interest is to utilize your credit report. A greater credit rating typically converts to lower rates of interest, so ensure your credit score record is exact before requesting a loan. If your rating is much less than optimal, take into consideration taking steps to improve it before bargaining rates.

In addition, want to work out other aspects of the loan, such as the funding term or deposit, to potentially safeguard an extra favorable interest rate. Keep in mind, the objective is to locate a balance that fits your economic scenario while minimizing the overall expense of borrowing.

Avoiding Usual Financing Risks

One critical element of securing a successful automobile funding deal is guiding clear of typical financing mistakes that can possibly thwart your monetary plans. One typical mistake to avoid is not completely comprehending the terms of the financing. It is necessary to very carefully review the rate of interest, financing term, and any kind of extra charges that may be consisted of in the site here financing agreement. Failing to comprehend these details could lead to unforeseen prices and monetary pressure in the future.

Another challenge to look out for is being enticed by reduced monthly settlements without thinking about the complete price of the financing. While a lower monthly payment may seem attractive, it can lead to a much longer loan term and greater general rate of interest payments. It's important to strike a balance in between a convenient monthly settlement and decreasing the total cost of the finance.

Additionally, succumbing to unneeded attachments such as extended service warranties or insurance coverage plans offered by the lending institution can pump up the price of your finance. Review whether these extras are really advantageous and necessary before dedicating to them. By being alert and educated, you can prevent these usual funding pitfalls and protect a car funding deal that lines up with your financial goals.

Verdict

To conclude, understanding the basics of automobile funding is crucial for making educated choices. By understanding funding basics, deciphering lease terms, contrasting alternatives wisely, negotiating rates of interest successfully, and staying clear of usual risks, customers can browse the globe of vehicle financing solutions with confidence. With this knowledge, individuals can safeguard the most effective financing terms and make sound financial choices when acquiring a lorry.

Danny Pintauro Then & Now!

Danny Pintauro Then & Now! Michelle Trachtenberg Then & Now!

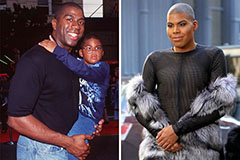

Michelle Trachtenberg Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now!